Easy Tax Free is coming for everyone

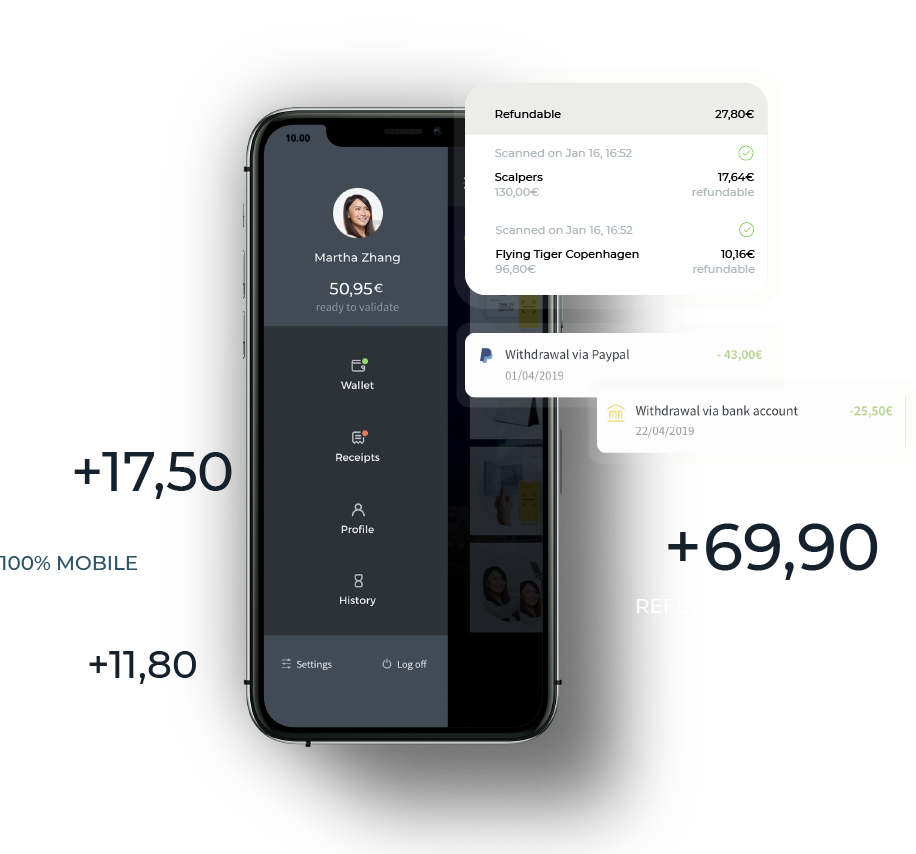

Travellers can claim their refund from their phones,

Retailers can increase their sales without effort and

Governments can attract tourists.

Traveller

Travellers can claim their refund 100% mobile.

Retailers

Retailers can increase their sales without cost nor integration.

Governments

We help governments leverage Fintech-grade digital technologies.

The Woonivers model

We are revolutionizing the way we shop while traveling.

Tax Free is meant to increase sales

We are Woonivers and we are here to change EVERYTHING

Time limit for customs approval:

Departure within three months from the month of purchase

No minimum spend

You can claim your Tax Free for any amount

Standard VAT:

21%

Food & Books:

4% - 10%

Give us a try!

We are commited to the United Nations Sustainable Development Goals

Woonivers is the only Tax Free solution making a positive impact in the world

We work towards building inclusive, safe, and sustainable cities. Our goal is to help all kinds of businesses and governments by being more competitive and efficient, unleashing dynamic and competitive forces that generate employment and income.

The FAQ's

Woonivers will support you and help you throughout the whole process to make your VAT refund a success.

What do I ask at the Store?

Simply ask for a ticket or invoice.

What kind of invoice I need to scan?

To ensure the perfect functioning of the App, please request a complete invoice from the store.

Some simple receipts may not be complete for reimbursement.

What goods are eligible to Tax Free?

All items for personal use that are not the object of commercial activity.

Is there a minimum amount I have to spend for Tax Free.

In Spain, there is no minimum amount to do Tax Free.

Am I eligible for Tax refunds?

Yes, if you are a resident outside of the European Union and your stay in the EU is less than six months.

As a European National, am I eligible for Tax Refunds?

Only non-residents of the European Community (for over 6 months of the year) are eligible to be considered for tax refunds. Note: Members of diplomatic and consular missions and international organizations posted to Spain are not eligible for tax refunds.

Are you a UK resident?

Since the application of Brexit, UK residents are also eligible to go Tax-Free shopping in Spain.

Spain is not your Exit point from the EU?

For flights with stopovers, you should print our QR form to be stamped by the customs service in the country you depart from (European Union country). Objects in your hand baggage must be certified by the services of the country you are passing through.

Examples:

You fly from Paris to Beijing (your country of residence), but a stopover in Madrid. You should validate your tax refund form in Madrid.

You fly from Paris to Beijing, but spend a few days in Madrid. You should validate your tax refund form in Madrid. Your last point of exit from the EU.

What should i know at the airport?

Note: Customs authorities in any of the 27 EU member states are mandated to validate Tax-Free forms issued in any of the other 26 EU member states.

Are you carrying your goods in your hold luggage or your hand luggage?

Hold Luggage: Before checking in your luggage, present yourself at the customs office in the departure hall. Subsequently, you must store the goods in your luggage and check this luggage in immediately.

Hand Luggage: Take your goods in your hand luggage through the security check and passport control.Subsequently, take your hand luggage to the nearest customs office.

Once there, show the documents and goods, Customs will stamp your invoice for export purposes.

Does Woonivers charge any fees for helping with your refund?

We are the only ones who don’t charge hidden fees. We are transparent and we cash-back you, at least, the refund table.

How long does it take to receive my refunds?

Nothing, as soon as you validate your forms and you are back in your residence country, your refunds will be available in your Woonivers Wallet to be transferred in your favorite payment method.